港股即時

Economic Calendar

Wednesday, October 5, 2016

債劵市場 比 股票市場 更敏感於政策變動所帶來的影響

To understand the financial markets, you need to understand the hierarchy of asset classes.

That hierarchy is as follows:

Globally, the stock market is about $69 trillion in size, trading about $191 billion in shares per day.

The bond markets are well north of $140 trillion, and trade about $700 billion in volume per day,

The bond market is the SMART money and reacts to major policy changes before stocks.

Reference:

http://www.zerohedge.com/news/2016-10-04/warning-bond-markets-are-signaling-something-massive-coming

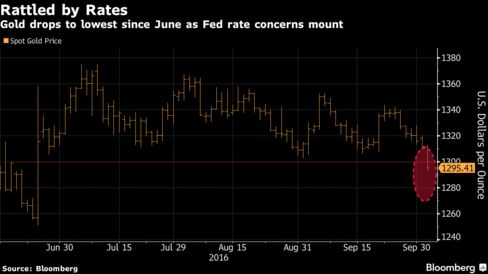

Gold price affected by the Fed?

最近金價跌破$1300。

點解?

http://www.bloomberg.com/news/articles/2016-10-04/gold-heads-for-longest-retreat-in-five-weeks-on-u-s-rate-view

厘段有提及幾個Federal Reserve Bank 人物講加息。

Fed Bank of Richmond President Jeffrey Lacker urged the central bank to raise rates to head off a likely pickup in inflation that would force bigger increases later. On Monday, Fed Bank of Cleveland President Loretta Mester said she expects the case for a hike to remain “compelling” at the next review in November.

http://www.reuters.com/article/us-usa-fed-evans-idUSKCN12503Z?il=0

厘段講 Chicago Federal Reserve Bank President Charles Evans 話如無意外美國經濟數據持向好的話,2016年12月會加息。

金價插水好大機會就係聯儲講加息,炒低金價。

#Fed也是財演

點解?

http://www.bloomberg.com/news/articles/2016-10-04/gold-heads-for-longest-retreat-in-five-weeks-on-u-s-rate-view

厘段有提及幾個Federal Reserve Bank 人物講加息。

Fed Bank of Richmond President Jeffrey Lacker urged the central bank to raise rates to head off a likely pickup in inflation that would force bigger increases later. On Monday, Fed Bank of Cleveland President Loretta Mester said she expects the case for a hike to remain “compelling” at the next review in November.

http://www.reuters.com/article/us-usa-fed-evans-idUSKCN12503Z?il=0

厘段講 Chicago Federal Reserve Bank President Charles Evans 話如無意外美國經濟數據持向好的話,2016年12月會加息。

金價插水好大機會就係聯儲講加息,炒低金價。

#Fed也是財演

Subscribe to:

Comments (Atom)